|

|

|

|

|

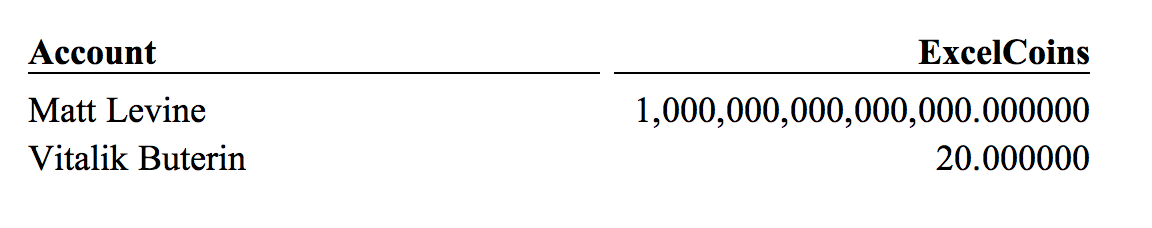

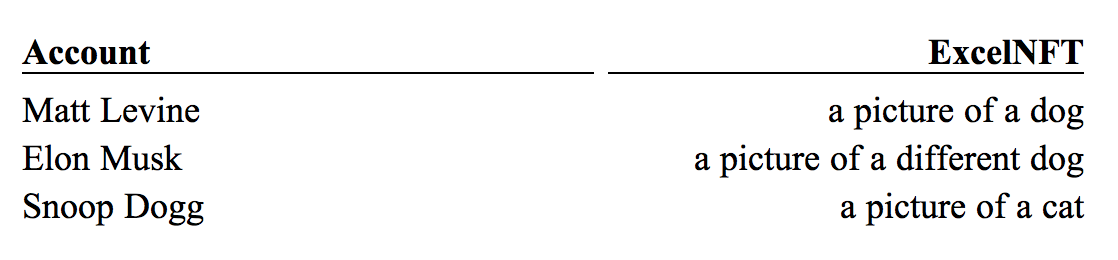

The only cryptocurrency that I own is ExcelCoin.[1] ExcelCoin is a next-generation cryptocurrency whose central innovation is that its ledger is maintained not by proof of work, which is environmentally problematic, or by proof of stake, which has its own problems, but by me. I maintain the ledger in Microsoft Excel. Here is a copy of the ledger as of 9 a.m. today[2]:  If you want to buy some of my quadrillion ExcelCoins, send me an email[3]; I will make a market at $0.99 bid / $1.01 offered,[4] though of course that is subject to change with market conditions.[5] Of course ExcelCoin started as a currency, a form of “digital cash,” but what is powerful about the concept is that in principle you could track any sort of asset using the same underlying technology (me typing in Excel). For instance you could extend the ExcelCoin technology to track not merely fungible tokens like coins, but also non-fungible tokens, where each entry in the ledger represents a unique asset. For instance:  This is just a toy example — why would you want me to write “a picture of a cat” next to your name on a list? — but with a little imagination you can see how powerful it could be. For instance, we could track real estate this way. I could write down a list of all the houses in my town and who owns them; to transfer ownership we could just update the entries on my list. As of yet my list in Excel does not carry any legal ownership rights; it does not sync up with, or supersede, the legal property registry. But I think that you will agree that it is a much more efficient and technologically advanced system than the old legal system of property registration on paper in dusty archives, so I think in the long run it is likely to win out. This is stupid, why is it stupid. The easy answer is that it is technologically stupid. Actual cryptocurrencies (and blockchain systems for NFTs, proposed blockchains for real estate, etc.) have a distributed consensus mechanism for updating their shared ledger, proof-of-stake or proof-of-work or some other mechanism that lets the participants in the system verify and collectively control the ledger. Whereas I can type whatever I want in Excel. If you buy some ExcelCoins from me and I delete your entry in my Excel ledger, you don’t have any ExcelCoins anymore, and what sort of system is that? A better answer is that it is socially stupid, because the person maintaining the ExcelCoin ledger is me, and I am obviously kidding. You should not trust me to maintain the ExcelCoin ledger, because I invented ExcelCoin as a joke about ledgers. On the other hand millions and millions of people own U.S. dollars, which means precisely that some bank has a list and there is an entry for them on that list. It’s probably not in Excel, but same basic idea: The bank has a list of dollars in its accounts, the list is not kept via any sort of consensus mechanism or blockchain or whatever; the bank just keeps the list using, uh, Cobol. But you (mostly) trust the bank to maintain the list, because among other things (1) it has a good track record of maintaining the list, (2) it has good commercial incentives to maintain the list, (3) it has powerful regulatory and legal incentives to maintain the list, etc.[6] The bank’s list is not any great shakes technologically, and 100 years ago banks kept very similar lists using pen and paper. This system of lists is not flawless — sometimes the banks mess up the lists! — but it is not howlingly stupid either, in the way that ExcelCoin is. It's very normal and standard and millions of people rely on it without thinking about it.[7] ExcelCoin is stupid not because I keep it in Excel; it's stupid because I keep it in Excel. On Friday Moxie Marlinspike wrote a blog post on “My first impressions of web3.” Marlinspike is a famous cryptographer and computer-security guy, the inventor of the Signal app, etc., and the post has gotten a ton of attention in the Web3 (and Web3-skeptical) world; it’s great and I recommend it highly and I will only scratch the surface of it here. One relevant point is that distributed ledgers are not necessarily a complete technological solution for asset ownership:

The NFT does not by itself convey ownership of the underlying thing in either a legal or practical sense. It conveys ownership in some more metaphysical sense: If you buy a Bored Ape Yacht Club NFT, then the people who are part of the BAYC NFT community will treat you as the owner of your ape. This is essentially a social fact and can be true even if the immutable code of the blockchain says that you don’t own the ape, because you were hacked or whatever. The technology is a scaffolding on which to hang a social system, but the social system is what does or does not convey “ownership” in a meaningful sense. Also the technology is totally centralized? Marlinspike goes on:

The technology behind OpenSea is not quite “OpenSea keeps a list, in Excel, of who owns which NFTs.” The underlying list is kept on the blockchain; it’s just that OpenSea can modify its version of the list however it wants, and its modifications are in practice pretty binding. And in fact there are regular rounds of stories in which (1) some gullible crypto guy hands out his private key to anyone who asks for it, (2) his NFTs get stolen, (3) he complains on Twitter, (4) he gets a major NFT marketplace to lock trading in his stolen NFTs, and (5) everyone writes articles like “ha ha ha you don’t like decentralization so much now do you?” This is fine, though, Web3 proponents argue, because OpenSea’s ability to act arbitrarily is limited by community standards. The open immutable blockchain still exists, so you can compare what OpenSea says to what the blockchain says. (Perhaps not with MetaMask, but the possibility exists.) If OpenSea’s list did not conform to what its customers expected — if it arbitrarily ignored the blockchain, if it let people claim NFTs that weren’t theirs, etc. — then everyone would take their apes elsewhere. But this is pretty much why people trust banks too! The essential protections are social, not technological. Marlinspike:

Similarly, technologically, ExcelCoin is in some ways better than other forms of crypto that rely on distributed consensus mechanisms. But socially it is much worse, not only because I am kidding and have done nothing to build up trust in ExcelCoin, but also because there is an enormous speculative bubble in crypto that does not apply to transparently non-crypto things like my dumb Excel joke. The power of distributed consensus and immutable blockchains is not that they are a better technology than, you know, some large trusted website keeping a list, which is kind of how Web3 works anyway. The power of distributed consensus and immutable blockchains is that they attract money, which is really how Web3 works.

Last year, a bunch of people enjoyed speculating on meme stocks like GameStop Corp. Many of them used Robinhood Markets Inc.’s brokerage app to do it. At one point, Robinhood briefly limited purchases of GameStop and a few other meme stocks due to clearinghouse issues, which made a lot of people very angry and gave rise to a bunch of conspiracy theories. Some meme-stock investors wanted to sue Robinhood over this, and in fact there was a class action lawsuit that was dismissed in November. You might look at this dynamic and say: Well, sure, the people who bought GameStop in a speculative frenzy want to sue Robinhood. They want to sue Robinhood because they are angry, and, in America, suing people is a form of catharsis and emotional satisfaction. And they want to sue Robinhood because they think they have a valid claim and want to get monetary compensation for their losses from not being able to buy GameStop stock at, uh, $300 a share I guess. But there is a third desire that they might have, beyond emotional satisfaction and financial compensation: They might want to have another speculative frenzy. They might want to turn their grievance against Robinhood into a speculative asset, and then get rich trading it. You might think that because:

Here is a story about a company that wants to do litigation financing and let regular people trade litigation-finance claims, but on the blockchain, blah blah blah, it is very much the usual stuff you’d expect. I tend to think that there is a long list of asset classes that regular people do not trade frequently, and people are constantly saying “what if we built technology to allow regular people to trade this asset class,” and my answer tends to be “they would not trade it because nobody wants this.” (People are constantly trying to get regular people to trade small slivers of individual office buildings, for no obvious reason.) Litigation finance, sure, whatever, I do not think that there’s a huge audience of people who want to research and bet on individual lawsuits, or that there's a huge pool of plaintiffs who want to finance their lawsuits by conducting a registered securities offering, but that is just one man’s opinion and yeah why not, go nuts. Possibly not this nuts:

But then there’s this:

“ILO” is “initial litigation offering.” How valuable was a GameStop-driven lawsuit against Robinhood? Well, the actual realized value seems to have been zero dollars, which is also the value that I personally would have predicted last year.[8] But could you have sold it for a bit more than its long-term fundamental value? To GameStop investors? In January 2021?

Sometimes I read about couples where one spouse works at a bank and the other works at a hedge fund and I think “ugh what a compliance nightmare.” Lots of regulated financial firms (and related firms like law firms, consultancies, etc.) have pretty strict rules about personal trading, to prevent their employees from using inside information inappropriately; they require pre-approval of trades, ban trading in names that employees are working on, or sometimes even ban all trading in individual stocks. And to avoid obvious gaming of these rules, they tend to extend to the employee’s family. If you work at a bank and your spouse is a schoolteacher, this is fine — though if your spouse is also a hobbyist stock trader you might have to make some difficult choices — but if you work at a bank and your spouse works at a hedge fund it seems harder. You can’t really expect the hedge fund to get pre-approval from the bank. I suppose people work this stuff out — there are lots of financial-industry couples — but it does seem like in concept it would be challenging.

Seems rough if you’re a congressperson married to a hedge fund manager but perhaps that is a feature, not a bug. I will say though that as far as I can tell most of the useful inside information that congresspeople get is about broad sectoral themes, not individual stocks; if you only own index funds and get a terrifying secret briefing about Covid, you could profitably dump those index funds without ever trading an individual stock. I guess the blind trust addresses that problem.

You wouldn’t know it from a quick look at Bloomberg, but the stock of AeroCentury Corp. closed at $47.99 on Friday. Then over the weekend it completed a 5-for-1 stock split, so Bloomberg’s historical price page retroactively adjusted to show a Friday closing price of $9.598. Then people woke up for pre-market trading this morning and … uh …

Basically what seems to have happened here is you have a computer program to buy and sell AeroCentury stock, and the program merrily goes along and closes Friday thinking that AeroCentury is trading at $47.99, and then based on that and developments over the weekend it thinks “I will buy AeroCentury at $47 or sell it at $49” or whatever (actual numbers not important), and then before Monday morning you either do or do not update the program to be like “don’t forget to divide everything by 5.” And some people do and some people don’t. And the people who don’t, their programs wake up at 4 a.m. with a $47.00 / $49.00 market for AeroCentury, and the people who do, their programs wake up at 4 a.m. on Monday with a a $9.40 / $9.80 market for AeroCentury, and the people who think about it for a moment longer wake up with a $9.40 / $45.00 market for AeroCentury and sell some stock to the people who forgot at comically inflated prices. And then the stock exchanges bust the trades because this stuff — setting up to profit from other people’s ignorance and fat fingers — is really more of a crypto thing.

There is so much more miscellaneous crypto stuff; a sample of headlines:

Do you like wine? Buy an NFT of wine. Do you like your senator? Buy an NFT of your senator. Do you like golf? Buy an NFT of a golf course. Uh … penguins? Everything.

World’s Biggest Crypto Fortune Began With a Friendly Poker Game. Inside private equity’s race to go public. The EU vs the City of London: a slow puncture. Rocket Grew Into America’s Biggest Mortgage Lender, but Now Comes the Hard Part. THG hands FCA dossier on City ‘conspiracy’ over share price plunge. Dirty-Money Ties Worried Some at Swedbank While Bosses Kept Mum. Two Chinese Startups Tried to Catch Up to Makers of Advanced Computer Chips—and Failed. McKinsey’s Top Executive Wants to Change How the Firm Operates. London law firms struggle to fill jobs as competition for applicants soars. Time for some game theory. Meet the man who runs a moist towelette museum out of a planetarium. If you'd like to get Money Stuff in handy email form, right in your inbox, please subscribe at this link. Or you can subscribe to Money Stuff and other great Bloomberg newsletters here. Thanks! [1] I gather that there is at least one other thing called “Excelcoin” that appears on CoinMarketCap etc., though it seems only barely to exist. To be clear I do not own that, do not endorse it, etc. I own the ExcelCoin that trades on my own copy of Microsoft Excel, which I made up as a joke in 2017. I am sure that, as a matter of parallel discovery, other people also made it up as a joke, or not as a joke. [2] It appears to be traditional to give Buterin some coins, as a tribute, whether or not he asks for them. He did not ask for these. Vitalik Buterin has no idea that he owns 20 ExcelCoins. Someone should tell him I guess. [3] Don’t actually. [4] To be clear, if Buterin wants to sell, I’ll absolutely Venmo him $19.80 for his 20 ExcelCoins. The ExcelCoin market does not support short selling at this time. [5] If I manage to sell any my bid is gonna drop to zero, is what this means. No refunds! All sales final! [6] If a bank president went into her bank’s list and changed it so that she owned all the money in all of her customers’ accounts, she would definitely go to prison for a long time. A good exercise is, when I go into my Excel spreadsheet and change the ExcelCoin ledger so that I own everyone else’s ExcelCoins, is that illegal or what? [7] Also I mean not to nitpick but the incidence of lost bank dollars is a whole lot lower than the incidence of lost Bitcoins. [8] I guess I did. “If Robinhood was legally obligated to let you buy all the stocks you want whenever you want, it would have been sued into oblivion long ago,” I wrote on Jan. 29, when the suit was filed. “They write the contracts better than that.” |

|

Follow Us

|

Get the newsletter |

|

|

|

Like Money Stuff? | Get unlimited access to Bloomberg.com, where you'll find trusted, data-based journalism in 120 countries around the world and expert analysis from exclusive daily newsletters. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |

| You received this message because you are subscribed to Bloomberg's Money Stuff newsletter. | |||

| Unsubscribe | Bloomberg.com | Contact Us | |||

|

|||

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |